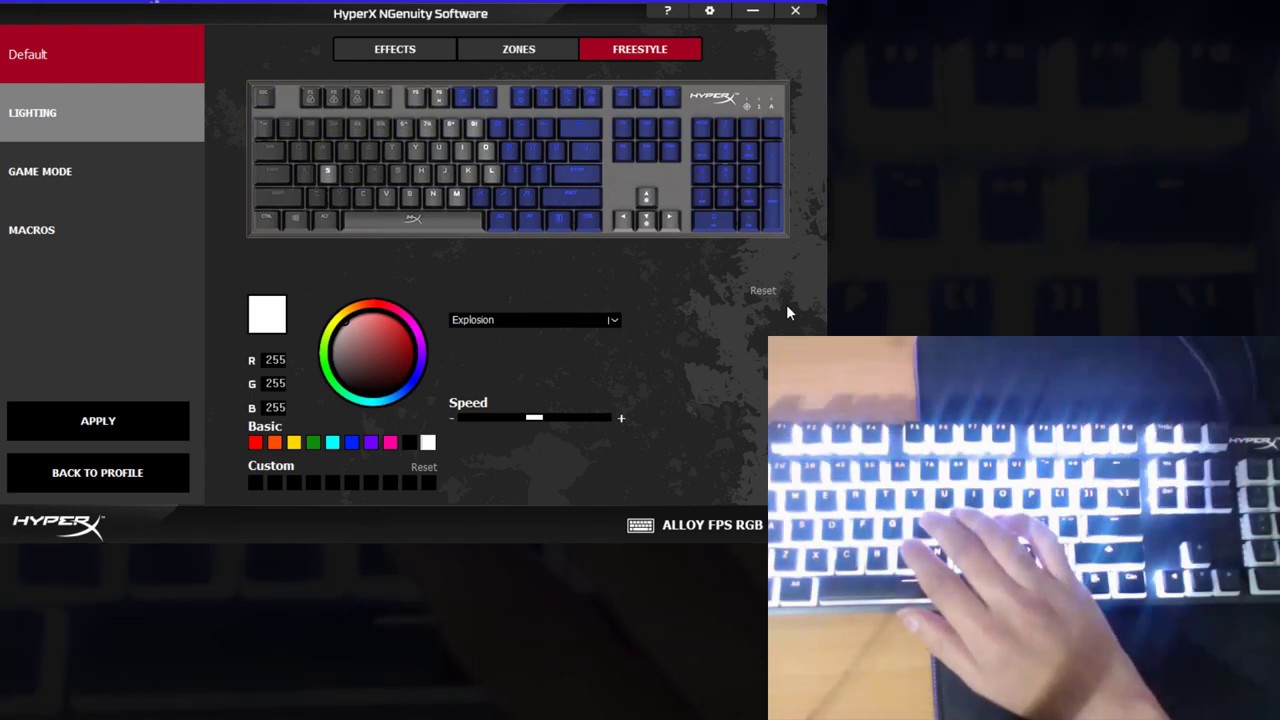

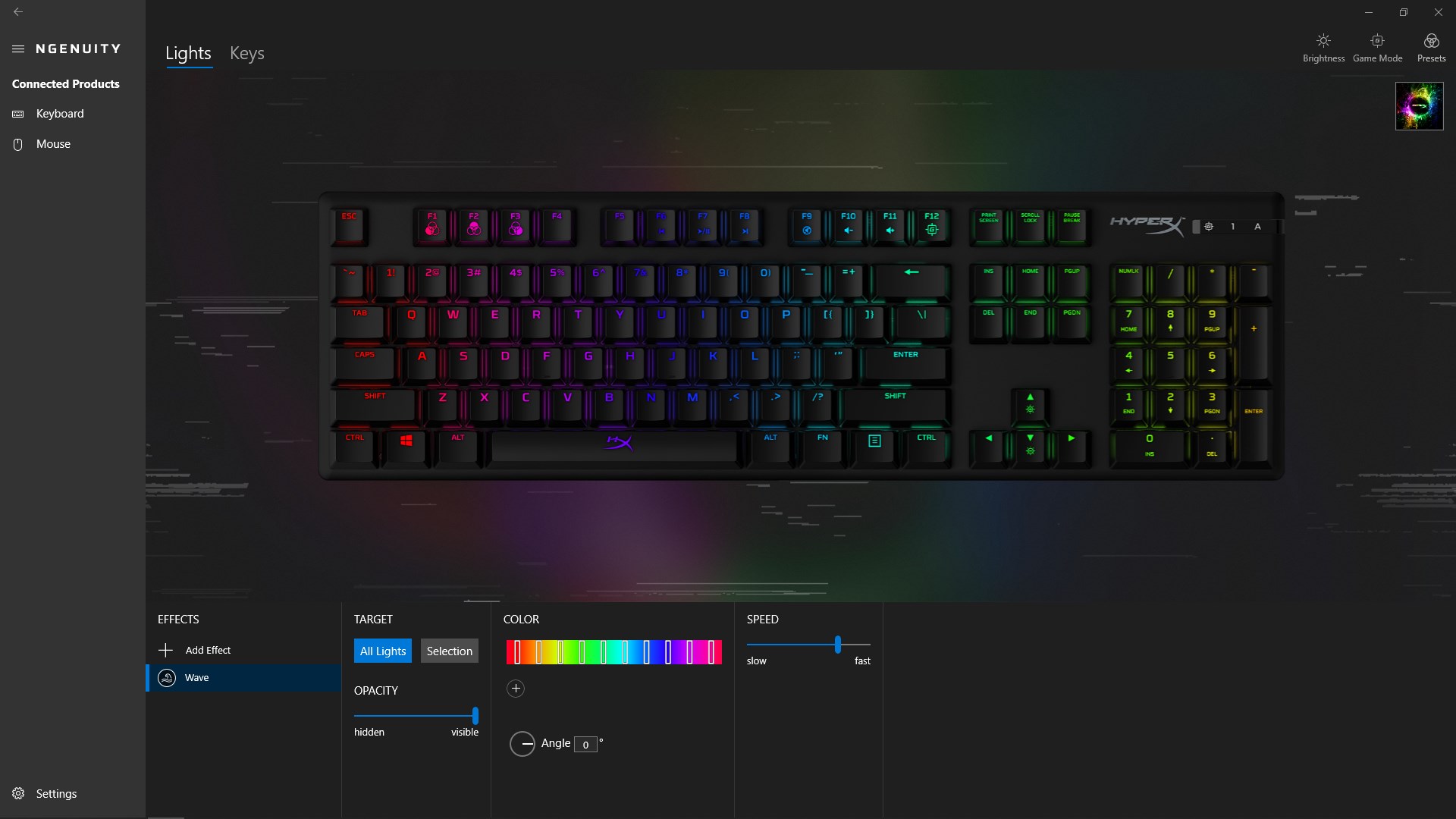

HyperX Ngenuity Software Tutorial - Mechanical Keyboards - RGB Presets, Key assigments & Macros - YouTube

Buy HyperX Alloy Origins 60 - Mechanical Gaming Keyboard, Ultra Compact 60% Form Factor, Double Shot PBT Keycaps, RGB LED Backlit, NGENUITY Software Compatible - Linear HyperX Red Switch Online at Lowest

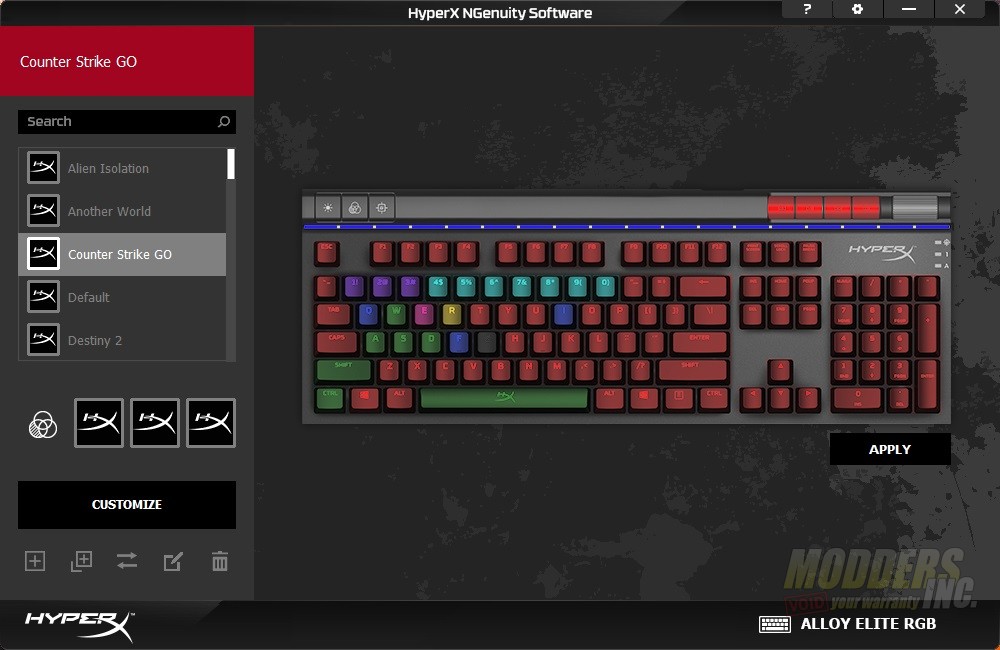

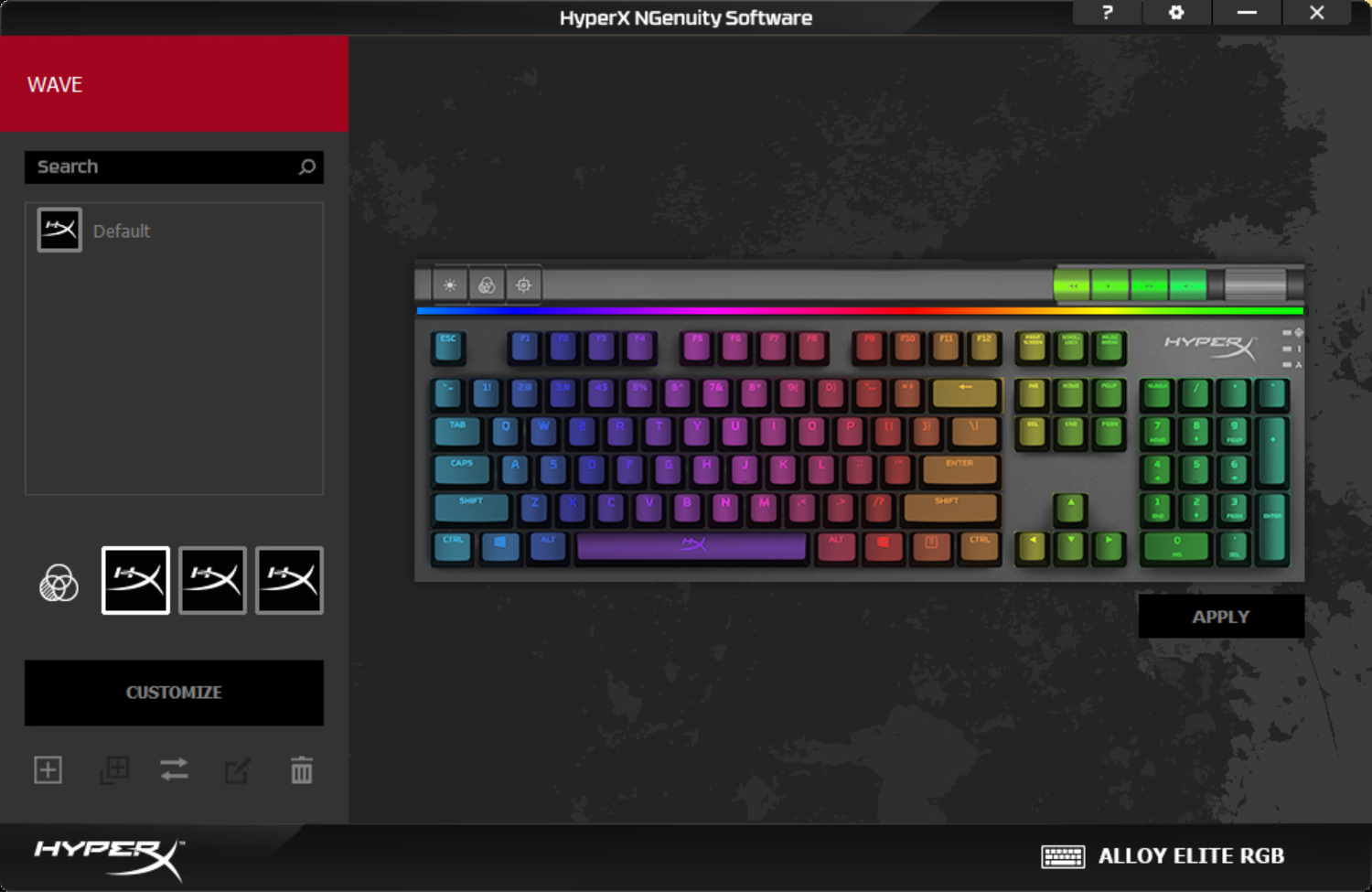

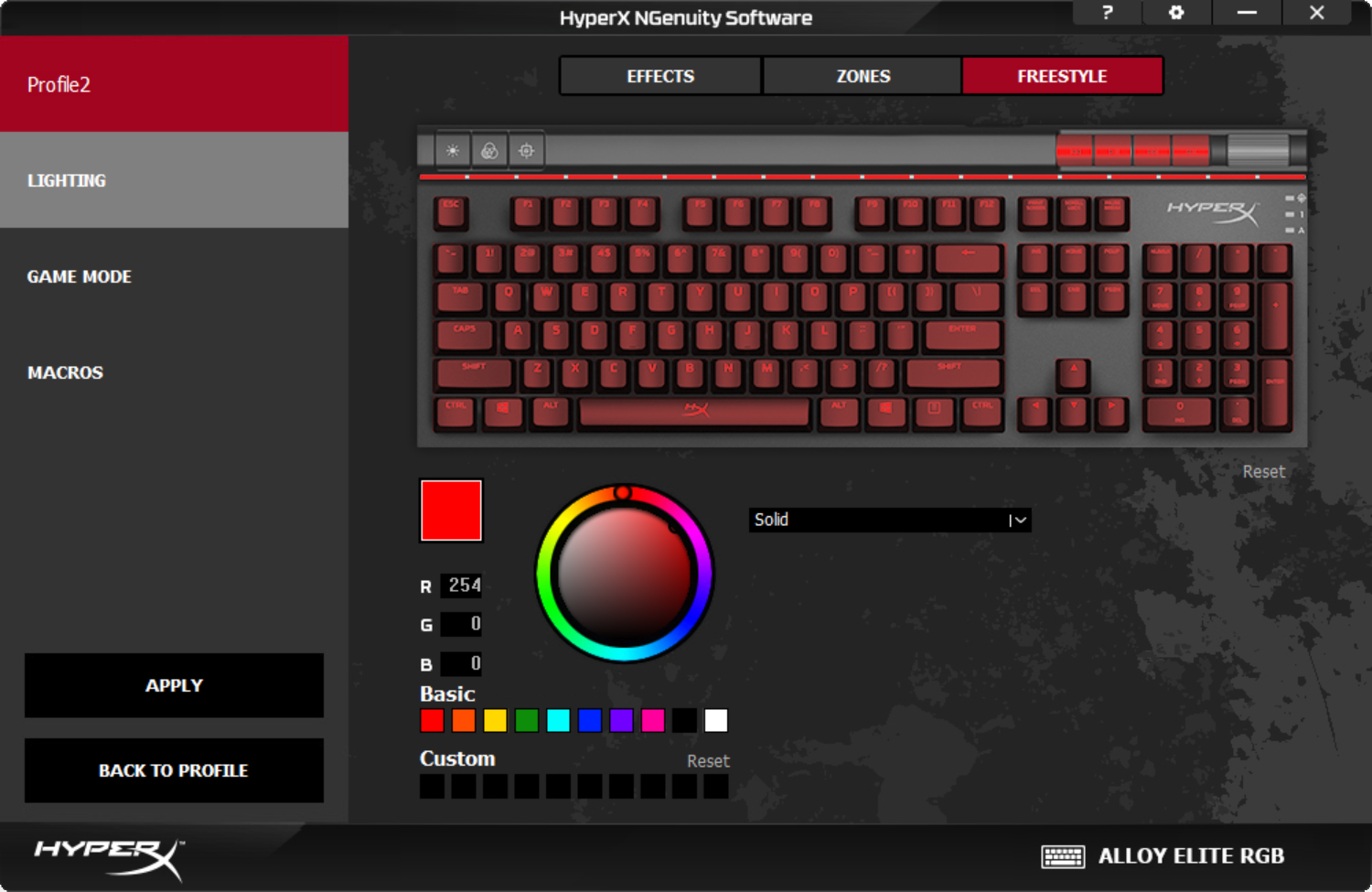

HYPER-X HYPERX ALLOY ELITE 2 WIRED RGB MECHANICAL GAMING KEYBOARD WITH HYPERX NGENUITY SOFTWARE AND PUDDING KEYCAPS (ABS) - RED LINEAR (HKBE2X-1X-US/G) | Lazada

HyperX Ngenuity Software Tutorial for Mechanical Keyboard - Save RGB Profiles and Macros MAY 2020 - YouTube